Final Account of Service Center of General Office of Sichuan Provincial People’s Government in 2020

catalogue

The first part   Unit profile

I. Brief introduction of functions

Second, the completion of key work in 2020

Iii. institutional setup

The second part   Description of the final accounts of the unit in 2020

First, the overall situation of income and expenditure accounts

Second, the income statement

Iii. Description of final accounts of expenditures

Four, the financial allocation of income and expenditure accounts of the overall situation

Five, the general public budget expenditure accounts.

Six, the general public budget financial allocation of basic expenditure accounts

Seven, "three public funds" financial allocation expenditure accounts.

Eight, the government fund budget expenditure accounts.

Nine, the state-owned capital operating budget expenditure accounts.

X. Description of other important matters

The third part   Noun interpretation

The fourth part   attachment

The fifth part   attached table

I. Summary of final accounts of income and expenditure

Second, the income statement

Iii. Final Statement of Expenditure

IV. Summary of Final Accounts of Financial Appropriation Income and Expenditure

V. List of final accounts of financial appropriation expenditure

Six, the general public budget expenditure final accounts

Seven, the general public budget expenditure final accounts list

Eight, the general public budget financial allocation basic expenditure statement

Nine, the general public budget financial allocation project expenditure statement

Ten, the general public budget financial allocation "three public" expenditure statement

Eleven, the government fund budget financial allocation income and expenditure statement

Twelve, the government fund budget financial allocation "three public" expenditure statement

Thirteen, the state-owned capital operating budget financial allocation income and expenditure statement

Fourteen, the state-owned capital operating budget financial allocation expenditure statement

The first part   Unit profile

I. Basic functions and main work

(1) Main functions. Responsible for serving the leaders of the provincial government; Responsible for the service guarantee of government vehicles, communications, text printing and property management; To undertake part of the routine work of administrative management entrusted by the organ, the management of fixed assets and the operation and management of operating assets entrusted by the organ.

(2) Key tasks in 2020. Work related to maintenance, reinforcement and supporting projects of dangerous office buildings in government compound, load reduction project of No.2 underground parking lot, epidemic prevention and control work, establishment of civil air defense underground passage project in government compound, establishment of renovation project of emergency command center in No.1 building, and some projects of comprehensive maintenance project in 2019.

(3) institutional setup. The office service center consists of five departments: comprehensive department, property management department, state-owned assets management department, engineering management department and life service department.

The second part   Description of the final accounts of the unit in 2020

First, the overall situation of income and expenditure accounts

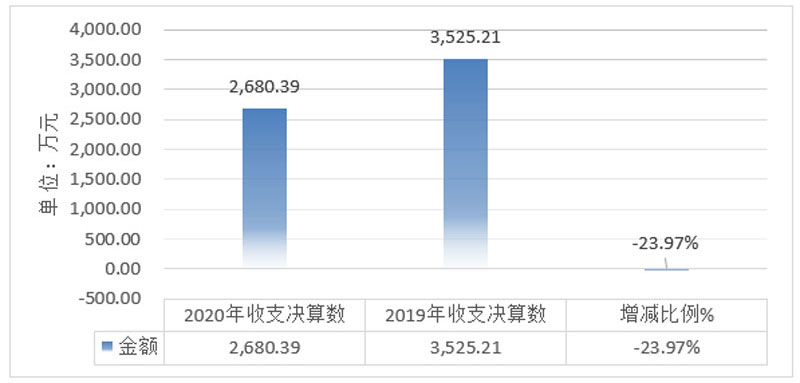

In 2020, the total revenue and expenditure was 26,803,900 yuan. Compared with 2019, the total revenue and expenditure decreased by 8,448,200 yuan, down by 23.97%. The main reason for the change is the decrease in project expenditure.

Figure 1: Changes in the total of final accounts of receipts and expenditures.

Second, the income statement

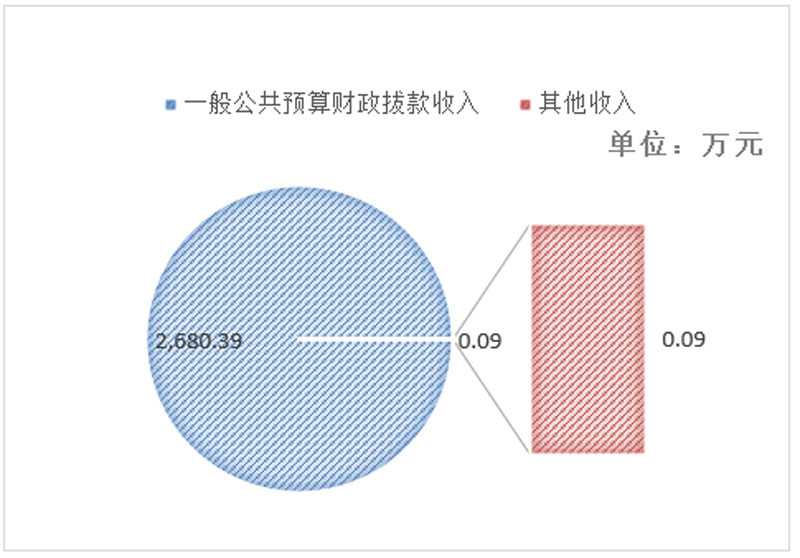

In 2020, the total revenue will be 26,803,900 yuan, of which: the revenue from the general public budget will be 26,803,100 yuan, accounting for 99.99%; Other income is 0.09 million yuan, accounting for 0.01%.

Figure 2: Structure diagram of income final accounts

Iii. Description of final accounts of expenditures

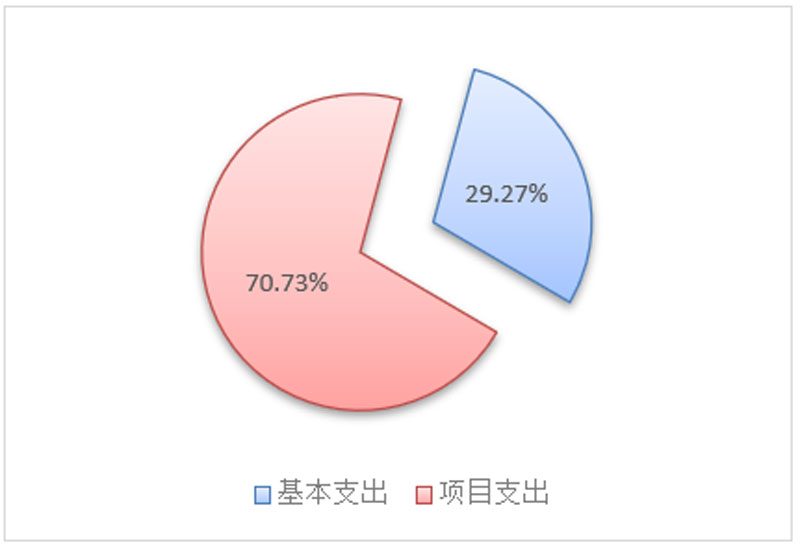

In 2020, the total expenditure this year was 26,792,300 yuan, of which: the basic expenditure was 7,842,800 yuan, accounting for 29.27%; The project expenditure is 18,949,500 yuan, accounting for 70.73%.

Figure 3: Structure diagram of expenditure final accounts

Four, the financial allocation of income and expenditure accounts of the overall situation

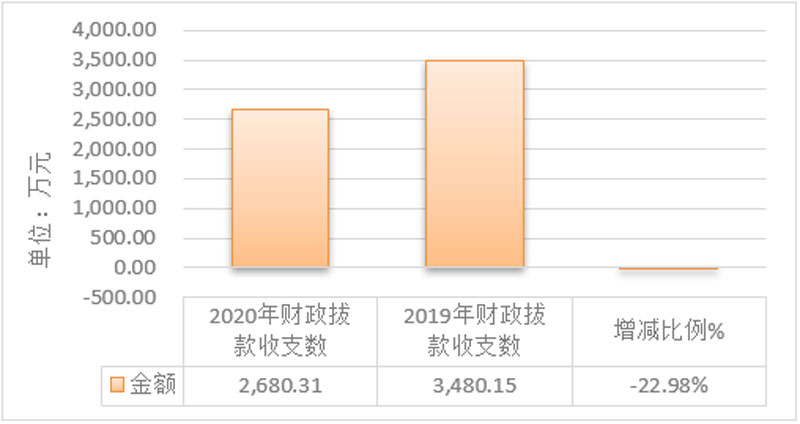

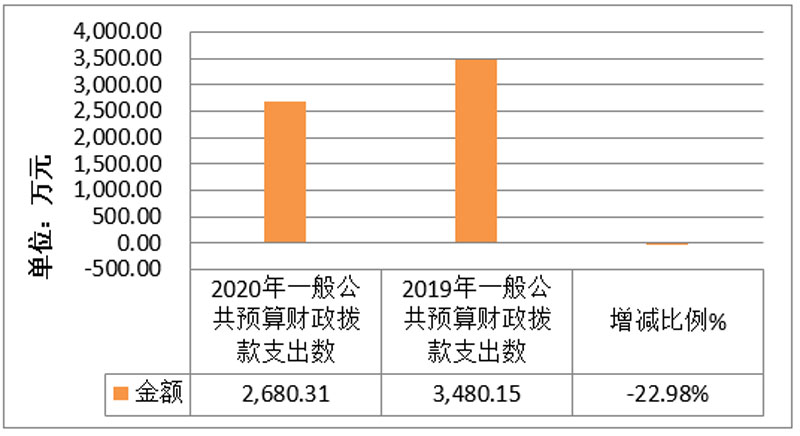

In 2020, the total revenue and expenditure of financial allocation was 26,803,100 yuan. Compared with 2019, the total revenue and expenditure of financial allocation decreased by 7,998,400 yuan, a decrease of 22.98%. The main reason for the change is the decrease in project income.

Figure 4: Changes in the total final accounts of financial appropriations.

Five, the general public budget expenditure accounts.

(a) the overall situation of the general public budget expenditure accounts

In 2020, the financial allocation expenditure of the general public budget was 26,803,100 yuan, accounting for 99.99% of the total expenditure this year. Compared with 2019, the financial allocation of the general public budget decreased by 7,998,400 yuan, a decrease of 22.98%. The main reason for the change is the decrease in project income and expenditure.

Figure 5: Changes in final accounts of financial allocation expenditure of general public budget

(two) the structure of the final accounts of the general public budget.

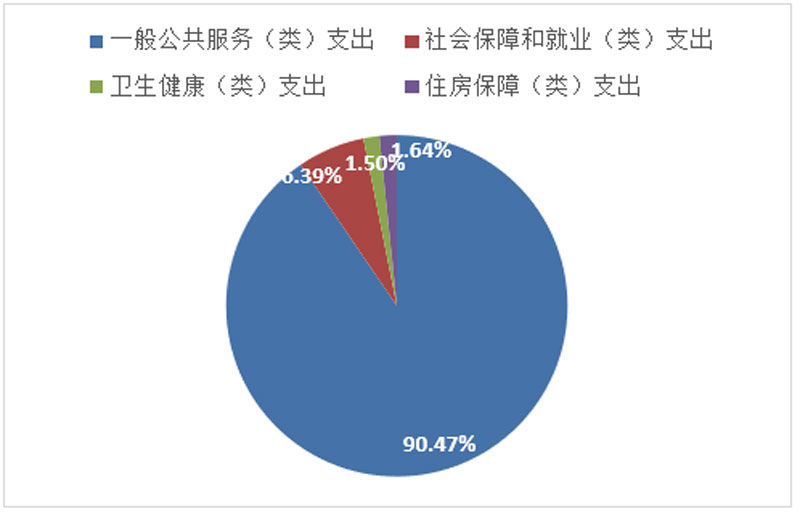

In 2020, the financial allocation expenditure of general public budget was 26,792,100 yuan, mainly used in the following aspects: the expenditure of general public services (categories) was 24,238,600 yuan, accounting for 90.47%; Expenditure on social security and employment (category) was 1,713,300 yuan, accounting for 6.39%; Health expenditure is 400,800 yuan, accounting for 1.5%; Expenditure on housing security was 439,600 yuan, accounting for 1.64%.

Figure 6: Final Account Structure of General Public Budget Financial Allocation Expenditure

(three) the specific situation of the general public budget expenditure accounts

In 2020, the final accounts of general public budget expenditures were 26,803,100 yuan, accounting for 96.07% of the budget. Among them:

1. General public services (classes) General administrative affairs (items) of government offices (rooms) and related institutional affairs (sections): The final expenditure was 9.865 million yuan, 94.07% of the budget was completed. The main reason why the final accounts were less than the budget was that part of the maintenance funds for office buildings were carried forward to the next year and the balance was recovered by the finance.

2. General public services (categories) Government offices (offices) and related institutional affairs (funds) Agency services (items): The final expenditure was 14,373,400 yuan, accounting for 98.37% of the budget.

3. Social security and employment expenditure (category) Pension expenditure of administrative institutions (item) Retirement of public institutions (item): The final expenditure is 838,100 yuan, and the budget is 100%.

4. Social security and employment expenditure (category) Pension expenditure of administrative institutions (paragraph) Expenditure of basic endowment insurance of government institutions (item): The final account of expenditure was 492,600 yuan, with 99.90% of the budget completed.

5. Social security and employment expenditure (category) Pension expenditure of administrative institutions (item) Occupational annuity payment expenditure of government institutions (item): The final expenditure is 345,200 yuan, and the budget is 100%.

6. Social security and employment expenditure (category) pension (paragraph) death pension (item) expenditure final accounts are 37,400 yuan, and the budget is 100%.

7. Health expenditure (category) Medical expenditure of administrative institutions (item) Medical expenditure of other institutions (item): The final accounts of expenditure were 400,800 yuan, and the budget was 100%.

8. Expenditure on housing security (category) Expenditure on housing reform (item) Housing accumulation fund (item): The final expenditure was 367,400 yuan, accounting for 68.75% of the budget.

9. Housing security expenditure (category) Housing reform expenditure (item) Housing subsidy (item): The final expenditure is 72,200 yuan, and the budget is 100%.

Six, the general public budget financial allocation of basic expenditure accounts

In 2020, the basic expenditure of the general public budget is 7,842,800 yuan, of which:

The personnel expenses are 6,833,300 yuan, mainly including: basic salary, allowance, bonus, food subsidy, performance salary, basic old-age insurance payment of institutions, occupational annuity payment, other social security payment, other salary and welfare expenses, retirement expenses, pension, living allowance, medical expenses subsidy, bonus, housing accumulation fund, and other subsidies for individuals and families.

The public funds are 1,009,500 yuan, mainly including: office expenses, printing fees, consulting fees, handling fees, water fees, electricity fees, post and telecommunications fees, heating fees, property management fees, travel expenses, expenses for going abroad on business, maintenance (protection) fees, rental fees, conference fees, training fees, official reception fees, labor fees, entrusted business fees and trade union funds.

Seven, "three public funds" financial allocation expenditure accounts.

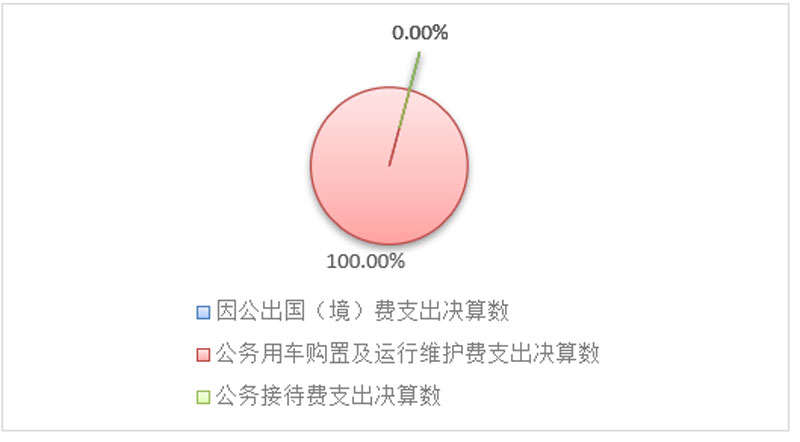

(a) the overall situation of the final accounts of the financial allocation of the "three public funds"

In 2020, the final accounts of the "three public" funds were 91,700 yuan, 94.54% of the budget was completed. The main reason why the final accounts were less than the budget was the reduction of vehicle refueling fees.

(two) the "three public funds" financial allocation expenditure accounts specific instructions.

In 2020, in the final accounts of the financial allocation expenditure of the "three public funds", the final accounts of the expenses for going abroad (the territory) on business were 0,000 yuan, accounting for 0%; The final accounts of official vehicle purchase and operation and maintenance expenses are 91,700 yuan, accounting for 100%; The final account of official reception expenses is 0,000 yuan, accounting for 0%. The details are as follows:

Figure 7: Expenditure structure of financial allocation for "three public funds"

1. The expenditure for going abroad (in the country) on business is 0,000 yuan, and the budget is 100%. In the whole year, 0 delegations were arranged to go abroad on business, and 0 people went abroad. Consistent with 2019.

2. The official car purchase and operation and maintenance expenses were 91,700 yuan, accounting for 94.54% of the budget. The final accounts of official vehicle purchase and operation and maintenance expenses decreased by 0.83 million yuan compared with 2019, down by 8.3%. The main reason is the reduction of vehicle refueling fees.

Among them, the official car purchase expenditure is RMB 0,000. The purchase of official vehicles was not updated throughout the year, and the number of vehicles was 2.Car,Vehicles are managed by the authorities in a unified way.

The official vehicle operation and maintenance expenses are 91,700 yuan. It is mainly used to ensure the daily work operation of the general office of the provincial government, the provincial government and the leaders of the general office go to the grassroots level to guide research, supervise and inspect, and emergency response and other related work.

3. The official reception expense is RMB 0,000, and the budget is 100%. The final accounts of official reception expenses are the same as those in 2019, both of which are 0,000 yuan.

Eight, the government fund budget expenditure accounts.

In 2020, there will be no government fund budget allocation expenditure.

Nine, the state-owned capital operating budget expenditure accounts.

In 2020, there will be no state-owned capital operating budget appropriation expenditure.

X. Description of other important matters

(a) the operating expenses of the organs

In 2020, my unit will be a public institution, and there will be no operating expenses.

(B) Government procurement expenditure

In 2020, there was no government procurement project in the service center of the General Office of Sichuan Provincial People’s Government.

(three) the possession and use of state-owned assets

As of December 31, 2020, the vehicle used by this unit is under the unified management of the general office.

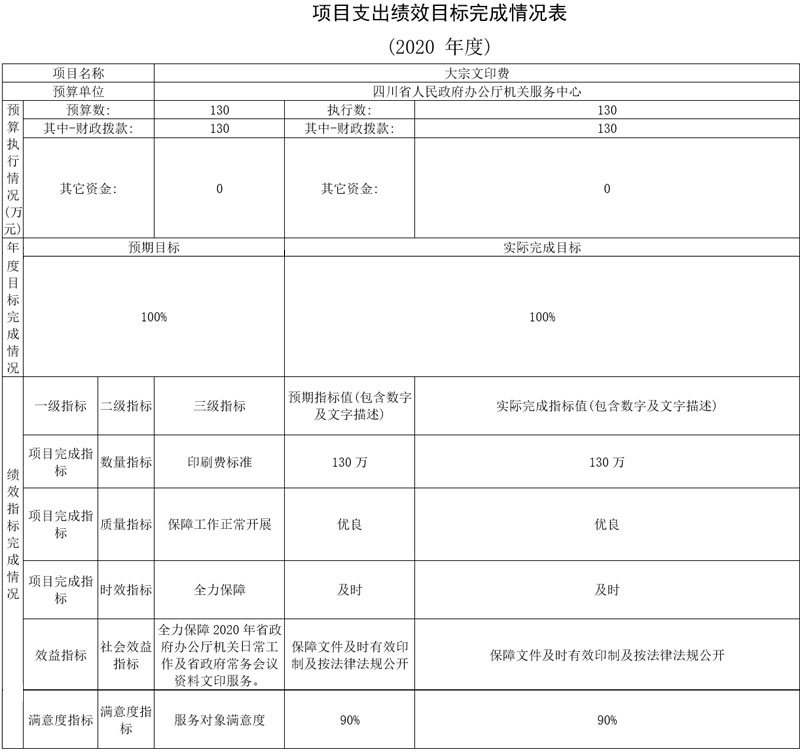

(IV) Budget performance management

According to the requirements of budget performance management, in the budget preparation stage of 2020, this unit organized the pre-budget performance evaluation of major research funding projects, and formulated performance targets for three projects. During the budget implementation, performance monitoring was carried out for three projects. After the year-end implementation, this unit conducted a performance self-evaluation of the overall expenditure of the unit in 2020 as required. Judging from the evaluation, the budget and final accounts of the service center of the provincial government office are reasonable, the expenditure is efficient and standardized, and the financial expenditure is ensured. The project implementation schedule and quality control specifications meet the performance target requirements at the beginning of the year.

1. Completion of project performance objectives.

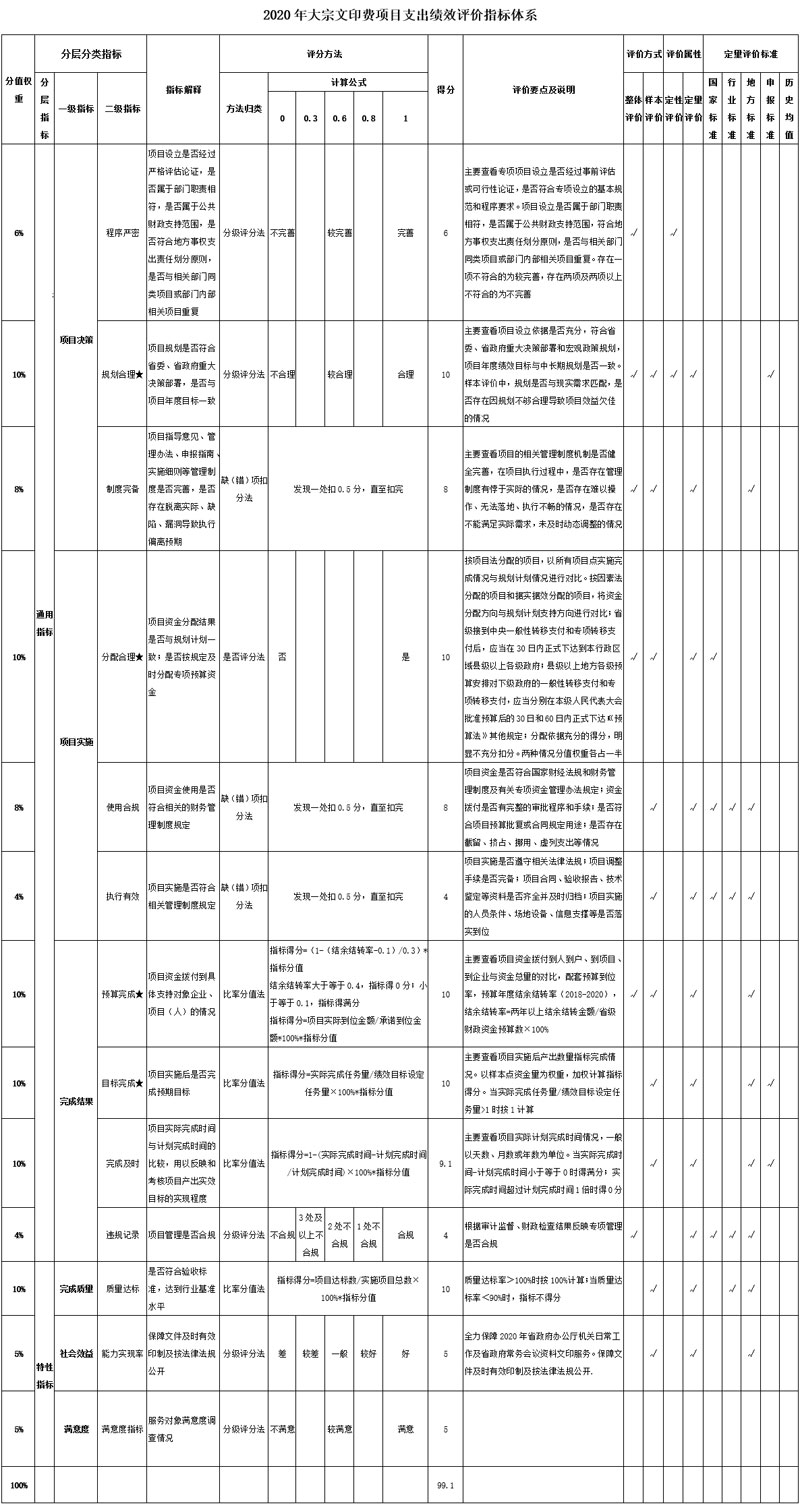

(1) Summary of the completion of performance targets of large-scale printing and printing fee projects in 2020. The annual budget of the project is 1.3 million yuan, and the implementation amount is 1.3 million yuan, which is 100% of the budget. Through the implementation of the project, we will fully guarantee the daily work of the general office of the provincial government and the information printing service of the provincial government executive meeting in 2020.

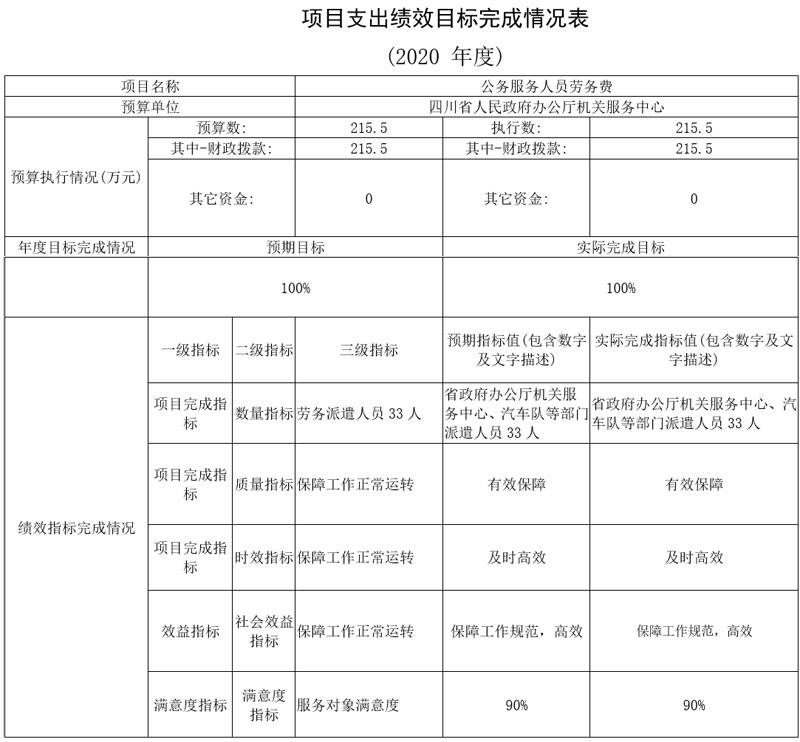

(2) Summary of the completion of the performance target of the service fee project of public servants in 2020. The annual budget of the project is 2.155 million yuan, and the implementation amount is 2.155 million yuan, which is 100% of the budget. There are 33 labor dispatchers, and the per capita labor cost is about 65,000 yuan (including social security, provident fund, trade union funds, residual insurance, etc.). Through the implementation of the project, we will make every effort to ensure the normal operation of the service center of the general office of the provincial government and the automobile fleet in 2020.

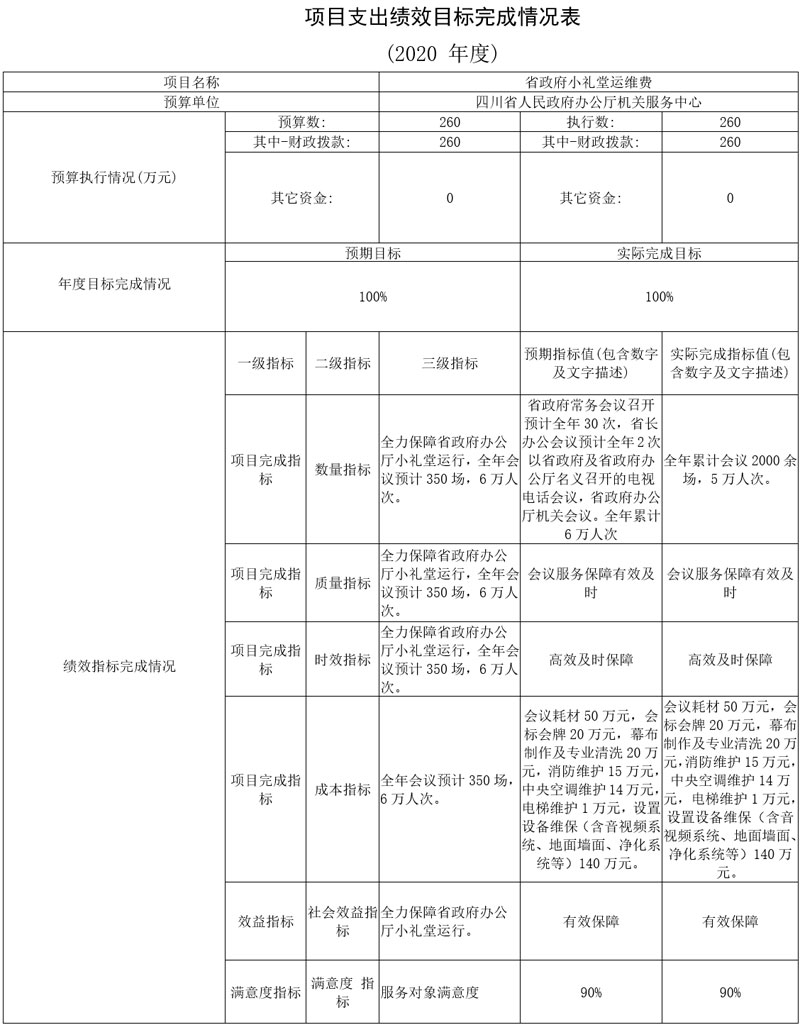

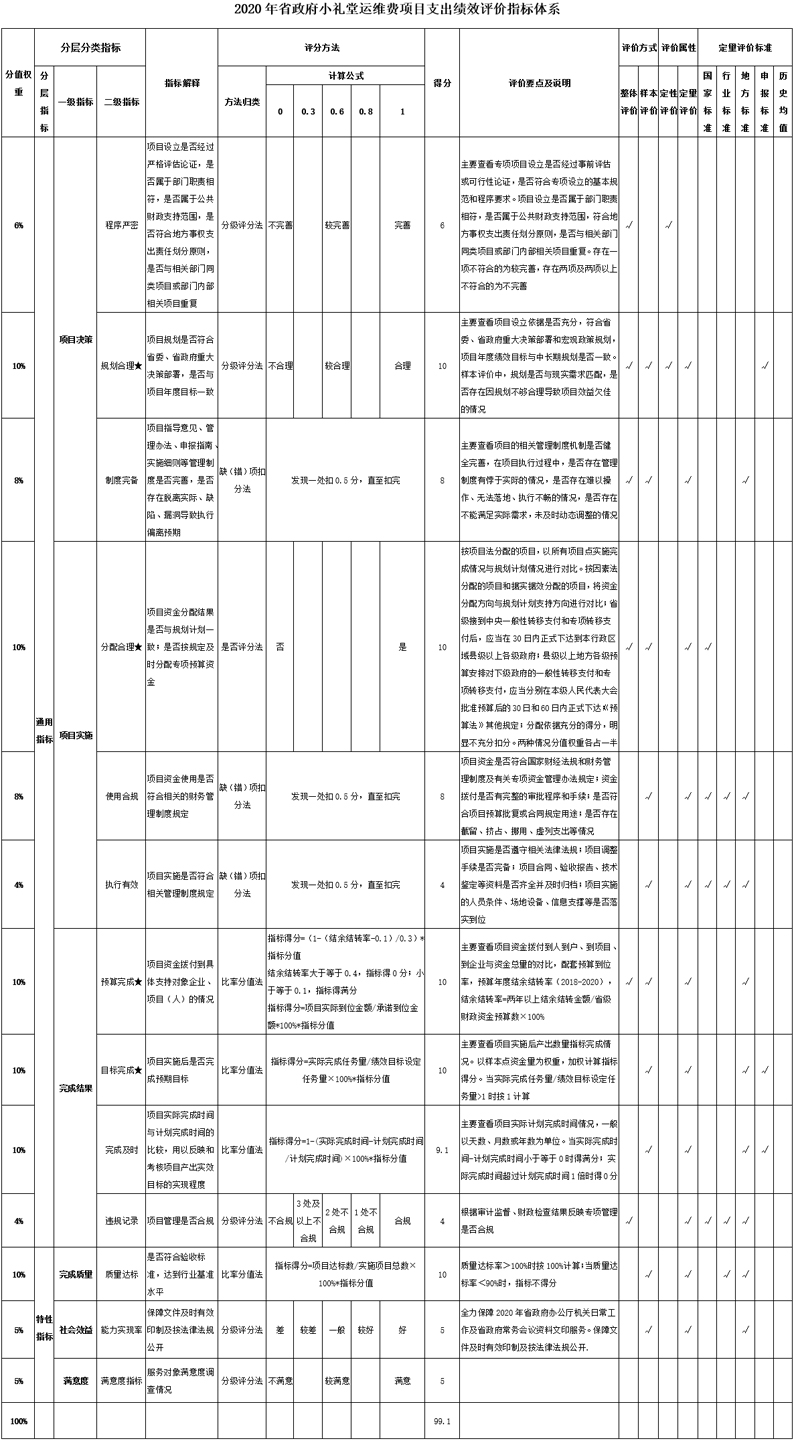

(3) Summary of the performance target of the provincial government’s small auditorium operation and maintenance fee project in 2020. The annual budget of the project is 2.6 million yuan, and the implementation amount is 2.6 million yuan, which is 100% of the budget. Through the implementation of the project, we will fully guarantee the operation of the small auditorium of the general office of the provincial government, including the provincial government executive meeting, the governor’s office meeting, the video conference held in the name of the provincial government and the general office of the provincial government, and the office meeting of the general office of the provincial government.

2. The unit performance evaluation results.

This unit organized its own performance evaluation on large-scale printing fees and other projects. See the Annex for the Report on Self-evaluation of Project Performance in 2020.

The third part   Noun interpretation

1. Income from general public budget appropriation: refers to the funds allocated by provincial finance in the current year.

2. Business income: refers to the income obtained by institutions from professional business activities and auxiliary activities.

3. Operating income of public institutions: refers to the income obtained by public institutions from non-independent accounting business activities other than professional business activities and auxiliary activities.

4. Other income: refers to income other than the above-mentioned "general public budget appropriation income", "business income" and "business income of public institutions". Mainly interest income from bank deposits.

5. Carry-over from the previous year: refers to the funds that have not been completed in the previous year and are carried over to this year to continue to be used according to relevant regulations.

6. General public service expenditure (category) Administrative operation of government offices (offices) and related institutional affairs (items): refers to the expenditure for ensuring the normal operation of administrative units and for administrative operation.

7. General public service expenditure (category) General administrative affairs (item) of government office (room) and related institutional affairs: refers to the expenditure on general administrative affairs to ensure the normal operation of various administrative institutions and to complete specific tasks.

8. General public service expenditure (category) Government office (room) and related institutional affairs (section) Agency services (item): refers to the expenditure for providing logistics services for administrative units.

9. General public service expenditure (category) Government office (office) and related institutional affairs (section) Counselor affairs (item): refers to the expenditure used for counselor affairs to complete specific work tasks.

10. General public service expenditure (category) Government office (room) and related institutional affairs (section) Business operation (item): refers to the expenditure for ensuring the normal operation of public institutions and for business operation.

11. Education expenditure (category) Further education and training (paragraph) Training expenditure (item): refers to the expenditure for ensuring the training of various administrative institutions.

12. Social security and employment expenditure (category) Pension expenditure of administrative institutions (paragraph) Retirement of administrative units (item): refers to the expenditure for retirees of administrative units.

13. Social security and employment expenditure (category) Pension expenditure of administrative institutions (paragraph) Expenditure of basic endowment insurance of government institutions (item): refers to the expenditure of basic endowment insurance of government institutions.

14. Social security and employment expenditure (category) Pension expenditure of administrative institutions (paragraph) Occupational annuity payment expenditure of government institutions (item): refers to the expenditure for occupational annuity payment of administrative institutions.

15. Social security and employment expenditure (category) Other social security and employment expenditure (paragraph) Other social security and employment expenditure (item): refers to the expenditure for unemployment insurance payment of public institutions.

16. Health expenditure (category) Medical treatment of administrative institutions (paragraph) Medical treatment of administrative units (item): refers to the expenditure for paying medical insurance for employees of administrative units according to policies.

17. Health expenditure (category) Medical treatment of administrative institutions (paragraph) Medical treatment of public institutions (item): refers to the expenditure for paying medical insurance for employees of public institutions according to policies and regulations.

18. Health expenditure (category) Medical treatment of administrative institutions (section) Medicaid for civil servants (item): refers to the expenditure for paying Medicaid for civil servants according to the policies and regulations.

19. Health expenditure (category) Medical expenditure of administrative institutions (paragraph) Medical expenditure of other administrative institutions (item): refers to the expenditure for institutions to pay work-related injury insurance for employees.

20. Housing security expenditure (category) Housing reform expenditure (paragraph) Housing provident fund (item): refers to the housing provident fund expenditure paid for employees according to the policy.

21. Housing security expenditure (category) Housing reform expenditure (paragraph) Housing subsidy (item): refers to the housing subsidy expenditure paid to employees without housing according to the policy.

22. Carry-over to the next year: refers to the funds arranged in the budget of this year or previous years, which cannot be implemented according to the original plan due to changes in objective conditions, and need to be postponed to the next year in accordance with relevant regulations.

23. Basic expenditure: refers to personnel expenditure and public expenditure incurred to ensure the normal operation of institutions and complete daily tasks.

24. Project expenditure: refers to the expenditure incurred to complete specific administrative tasks and career development goals in addition to basic expenditure.

25. "Three Public Funds": The "three public funds" included in the management of provincial financial budget and final accounts refer to the expenses for going abroad (abroad), the purchase and operation of official vehicles and the official reception expenses arranged by the unit with financial allocations. Among them, the expenses for going abroad on business reflect the international travel expenses, inter-city transportation expenses, accommodation expenses, meals, training fees, public miscellaneous expenses and other expenses of the unit going abroad on business; The purchase and operation expenses of official vehicles reflect the purchase expenses of official vehicles (including vehicle purchase tax) and the expenses of fuel, maintenance, crossing the bridge, insurance and safety incentives; The official reception fee reflects all kinds of official reception (including foreign guests’ reception) expenses of the unit according to the regulations.

26. Operating expenses of organs: funds used to purchase goods and services to ensure the operation of administrative units (including institutions governed by the Civil Service Law), including office and printing expenses, post and telecommunications expenses, travel expenses, conference expenses, welfare expenses, daily maintenance expenses, special materials and general equipment purchase expenses, office space utilities, office space heating expenses, office space property management expenses, official vehicle operation and maintenance expenses and other expenses.

The fourth part   attachment

Expenditure on large-scale printing and printing fees in 2020

Performance self-evaluation report

I. Basic information

The annual budget of the bulk printing fee project is 1.3 million yuan. Through the implementation of the project, the daily work of the general office of the provincial government and the information printing service of the provincial government executive meeting in 2020 will be fully guaranteed.

Second, the evaluation work.

The overall evaluation is mainly adopted in the project evaluation, and the score is carried out by combining qualitative and quantitative methods. The quantitative evaluation standard is based on national standards, industry standards, local standards and reporting standards. The evaluation index system includes general indicators and characteristic indicators, in which the general indicators mainly reflect the results of project decision-making, project implementation and project completion; Characteristic indicators mainly reflect the quality of project completion, social benefits and satisfaction.

Third, the comprehensive evaluation conclusion (attached to the score sheet)

The annual budget of large-scale printing fee projects is 1.3 million yuan, and the implementation amount is 1.3 million yuan, which is 100% of the budget. The project establishment procedure is strict, the planning is reasonable, the distribution is reasonable, the use is in compliance, and there is no violation. According to the "2021 Provincial Special Budget Project Expenditure Performance Evaluation Index System" of the Department of Finance, the project performance evaluation score is 99.1.

Fourth, performance evaluation and analysis

(A) the decision-making situation of the project

After strict argumentation, the large-scale printing fee project has reasonable planning and perfect management system, and its scope of use is consistent with the annual target.

(II) Project management

The project funds are allocated reasonably according to the planned scope, specified time and schedule. The use of funds conforms to the relevant financial system.

(III) Project output

Through the implementation of the project, the daily work of the general office of the provincial government and the information printing service of the executive meeting of the provincial government will be guaranteed in 2020.

(IV) Project benefits

Through the implementation of the project, ensure the timely and effective printing of documents and disclosure according to laws and regulations.

1. Attachment: Scoring Table for Large-scale Printing Fees in 2020

1. Scoring methods are classified into six categories: (1) Scoring method: it is applicable to positive and negative judgment indicators such as compliance, with full score in the positive direction and 0 score in the negative direction. (2) Graded scoring method: N-level weights are set for index scoring, and the index score is calculated according to the weights of the interval where the index value is located. (3) Ratio score method: for indicators with continuous ratio, the score is calculated by multiplying the ratio by the index score. (4) Deduction method for missing (wrong) items: calculated according to the required items, all items have full marks, and X points will be deducted for missing items. (5) Satisfaction value scoring method: Set a satisfaction value. If the index value reaches satisfaction, it deserves full marks; if it does not reach satisfaction, it will not be scored or deducted. (6) Cumulative method by number: if necessary, it can be used to add points.

2, the budget performance indicators:

(1) Qualitative index standard: judging the index score according to the objective basis, generally using the scoring method.

(2) Quantitative index standards: (technical standards, management standards, work standards):

National standards: formulated by the State General Administration of Quality and Technical Supervision and the State Standardization Administration Committee, which are applicable throughout the country, and standards at other levels shall not contradict them.

Industry standards: formulated by the administrative department of the State Council, and the industry standards are used in specific industries.

Local standards: In the absence of national standards and industry standards, local governments, provincial authorities and financial departments can set performance standards according to historical data, statistical data and survey data, and can set standards according to the actual situation in Sichuan according to economic sectors.

Declaration standard: On the basis of the newly implemented policy project and the lack of relevant basic data, all parties agree on the performance standard according to the pilot exploration, and dynamically revise and improve it in future years.

3. ★ is the core indicator, which needs the evaluation team to focus on in-depth analysis. For projects that do not involve personality indicators, the score weight will be adjusted to other effect indicators in proportion.

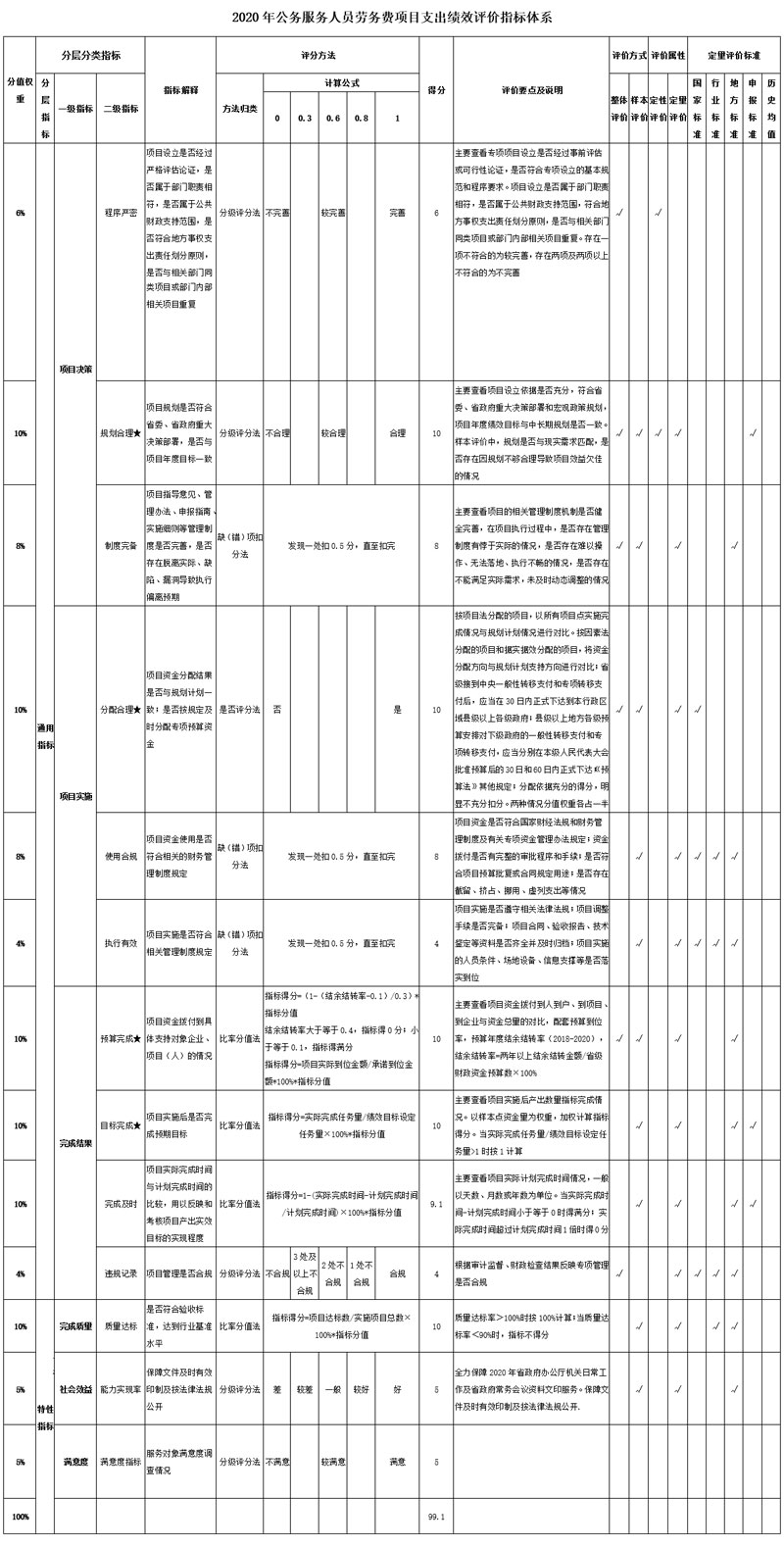

Labor expenses of public servants in 2020

Expenditure performance self-evaluation report

I. Basic information

The annual budget of the service fee project for public servants is 2.155 million yuan. Through the implementation of the project, the normal operation of the general office of the provincial government will be fully guaranteed in 2020.

Second, the evaluation work.

The overall evaluation is mainly adopted in the project evaluation, and the score is carried out by combining qualitative and quantitative methods. The quantitative evaluation standard is based on national standards, industry standards, local standards and reporting standards. The evaluation index system includes general indicators and characteristic indicators, in which the general indicators mainly reflect the results of project decision-making, project implementation and project completion; Characteristic indicators mainly reflect the quality of project completion, social benefits and satisfaction.

Third, the comprehensive evaluation conclusion (attached to the score sheet)

The annual budget of the service fee project for public servants is 2.155 million yuan, and the implementation amount is 2.155 million yuan, which is 100% of the budget. There are 33 labor dispatchers, and the per capita labor cost is about 65,000 yuan (including social security, provident fund, trade union funds, residual insurance, etc.). According to the Performance Evaluation Index System of Provincial Special Budget Projects in 2021 issued by the Department of Finance, the project performance evaluation score is 99.1.

Fourth, performance evaluation and analysis

(A) the decision-making situation of the project

After strict argumentation, the service fee items of public servants have reasonable planning and perfect management system, and the scope of use is consistent with the annual target.

(II) Project management

The project funds are allocated reasonably according to the planned scope, specified time and schedule. The use of funds conforms to the relevant financial system. The labor cost of labor dispatch personnel (33 people) is 2.155 million yuan, and the per capita cost is about 65,000 yuan (including social security, provident fund, trade union funds, residual insurance, etc.).

(III) Project output

Through the implementation of the project, the labor cost of the labor dispatch personnel (33 people) is 2.155 million yuan, and the per capita cost is about 65,000 yuan (including social security, provident fund, trade union funds, residual insurance, etc.).

(4) The benefits of the project.

Through the implementation of the project, we will make every effort to ensure the normal operation of the service center of the provincial government office and the automobile team in 2020.

1. Scoring methods are classified into six categories: (1) Scoring method: it is applicable to positive and negative judgment indicators such as compliance, with full score in the positive direction and 0 score in the negative direction. (2) Graded scoring method: N-level weights are set for index scoring, and the index score is calculated according to the weights of the interval where the index value is located. (3) Ratio score method: for indicators with continuous ratio, the score is calculated by multiplying the ratio by the index score. (4) Deduction method for missing (wrong) items: calculated according to the required items, all items have full marks, and X points will be deducted for missing items. (5) Satisfaction value scoring method: Set a satisfaction value. If the index value reaches satisfaction, it deserves full marks; if it does not reach satisfaction, it will not be scored or deducted. (6) Cumulative method by number: if necessary, it can be used to add points.

2, the budget performance indicators:

(1) Qualitative index standard: judging the index score according to the objective basis, generally using the scoring method.

(2) Quantitative index standards: (technical standards, management standards, work standards):

National standards: formulated by the State General Administration of Quality and Technical Supervision and the State Standardization Administration Committee, which are applicable throughout the country, and standards at other levels shall not contradict them.

Industry standards: formulated by the administrative department of the State Council, and the industry standards are used in specific industries.

Local standards: In the absence of national standards and industry standards, local governments, provincial authorities and financial departments can set performance standards according to historical data, statistical data and survey data, and can set standards according to the actual situation in Sichuan according to economic sectors.

Declaration standard: On the basis of the newly implemented policy project and the lack of relevant basic data, all parties agree on the performance standard according to the pilot exploration, and dynamically revise and improve it in future years.

3. ★ is the core indicator, which needs the evaluation team to focus on in-depth analysis. For projects that do not involve personality indicators, the score weight will be adjusted to other effect indicators in proportion.

2. Attachment: 2020 Service Fee Item Scoring Table for Public Servants

Provincial government small auditorium operation and maintenance fee project in 2020

Expenditure performance self-evaluation report

I. Basic information

The annual budget of the provincial government auditorium operation and maintenance fee project is 2.6 million yuan. Through the implementation of the project, the operation of the auditorium of the general office of the provincial government is fully guaranteed, including the provincial government executive meeting, the governor’s office meeting, the video conference held in the name of the provincial government and the general office of the provincial government, and the office meeting of the general office of the provincial government.

Second, the evaluation work.

The overall evaluation is mainly adopted in the project evaluation, and the score is carried out by combining qualitative and quantitative methods. The quantitative evaluation standard is based on national standards, industry standards, local standards and reporting standards. The evaluation index system includes general indicators and characteristic indicators, in which the general indicators mainly reflect the results of project decision-making, project implementation and project completion; Characteristic indicators mainly reflect the quality of project completion, social benefits and satisfaction.

Third, the comprehensive evaluation conclusion (attached to the score sheet)

The annual budget of the provincial government’s small auditorium operation and maintenance fee project is 2.6 million yuan, and the implementation amount is 2.6 million yuan, which is 100% of the budget. According to the "2021 Provincial Special Budget Project Expenditure Performance Evaluation Index System" of the Department of Finance, the project performance evaluation score is 99.1.

Fourth, performance evaluation and analysis

(A) the decision-making situation of the project

The provincial government’s small auditorium operation and maintenance fee project has been strictly demonstrated, and the planning is reasonable, the management system is perfect, and the scope of use is consistent with the annual target.

(II) Project management

The project funds are allocated reasonably according to the planned scope, specified time and schedule. The use of funds conforms to the relevant financial system. 500,000 yuan for conference consumables, 200,000 yuan for logo cards, 200,000 yuan for curtain production and professional cleaning, 150,000 yuan for fire protection, 140,000 yuan for central air conditioning maintenance, 10,000 yuan for elevator maintenance, and 1.4 million yuan for facilities and equipment maintenance (including audio and video systems, ground walls, purification systems, etc.).

(III) Project output

Through the implementation of the project, the operation of the small auditorium of the general office of the provincial government was fully guaranteed, with more than 300 meetings and about 60,000 person-times.

(IV) Project benefits

Through the implementation of the project, the operation of the small auditorium of the general office of the provincial government was fully guaranteed, with more than 300 meetings and about 60,000 person-times.

3. Attachment: Scoring Table of Small Auditorium Operation and Maintenance Fees of the Provincial Government in 2020

1. Scoring methods are classified into six categories: (1) Scoring method: it is applicable to positive and negative judgment indicators such as compliance, with full score in the positive direction and 0 score in the negative direction. (2) Graded scoring method: N-level weights are set for index scoring, and the index score is calculated according to the weights of the interval where the index value is located. (3) Ratio score method: for indicators with continuous ratio, the score is calculated by multiplying the ratio by the index score. (4) Deduction method for missing (wrong) items: calculated according to the required items, all items have full marks, and X points will be deducted for missing items. (5) Satisfaction value scoring method: Set a satisfaction value. If the index value reaches satisfaction, it deserves full marks; if it does not reach satisfaction, it will not be scored or deducted. (6) Cumulative method by number: if necessary, it can be used to add points.

2, the budget performance indicators:

(1) Qualitative index standard: judging the index score according to the objective basis, generally using the scoring method.

(2) Quantitative index standards: (technical standards, management standards, work standards):

National standards: formulated by the State General Administration of Quality and Technical Supervision and the State Standardization Administration Committee, which are applicable throughout the country, and standards at other levels shall not contradict them.

Industry standards: formulated by the administrative department of the State Council, and the industry standards are used in specific industries.

Local standards: In the absence of national standards and industry standards, local governments, provincial authorities and financial departments can set performance standards according to historical data, statistical data and survey data, and can set standards according to the actual situation in Sichuan according to economic sectors.

Declaration standard: On the basis of the newly implemented policy project and the lack of relevant basic data, all parties agree on the performance standard according to the pilot exploration, and dynamically revise and improve it in future years.

3. ★ is the core indicator, which needs the evaluation team to focus on in-depth analysis. For projects that do not involve personality indicators, the score weight will be adjusted to other effect indicators in proportion.

The fifth part   attached table

I. Summary of final accounts of income and expenditure

Second, the income statement

Iii. Final Statement of Expenditure

IV. Summary of Final Accounts of Financial Appropriation Income and Expenditure

V. List of final accounts of financial appropriation expenditure

Six, the general public budget expenditure final accounts

Seven, the general public budget expenditure final accounts list

Eight, the general public budget financial allocation basic expenditure statement

Nine, the general public budget financial allocation project expenditure statement

Ten, the general public budget financial allocation "three public" expenditure statement

Eleven, the government fund budget financial allocation income and expenditure statement

Twelve, the government fund budget financial allocation "three public" expenditure statement

Thirteen, the state-owned capital operating budget financial allocation income and expenditure statement

Fourteen, the state-owned capital operating budget financial allocation expenditure statement

![]() Schedule of Final Accounts of Service Center of General Office of Sichuan Provincial People’s Government in 2020

Schedule of Final Accounts of Service Center of General Office of Sichuan Provincial People’s Government in 2020